Franchise Buyer Persona Profile: The Multi-Unit / Multi-Brand Mogul

The Multi-Unit / Multi-Brand Mogul is a capitalized, ROI-driven operator who builds an enterprise, not a job—using franchising as a scalable asset class and portfolio, rather than a single-business career move. This persona thinks in terms of platforms, territories, and exit value, often controlling multiple units and brands across regions, industries, and business models

Who Is the Multi-Unit / Multi-Brand Mogul?

Multi-unit and multi-brand franchise Moguls are seasoned business builders who view franchising as a vehicle for scale, diversification, and long-term wealth creation. They tend to be older than first-time entrepreneurs, already proven as operators or executives, and focused on building a sizable, transferable enterprise.

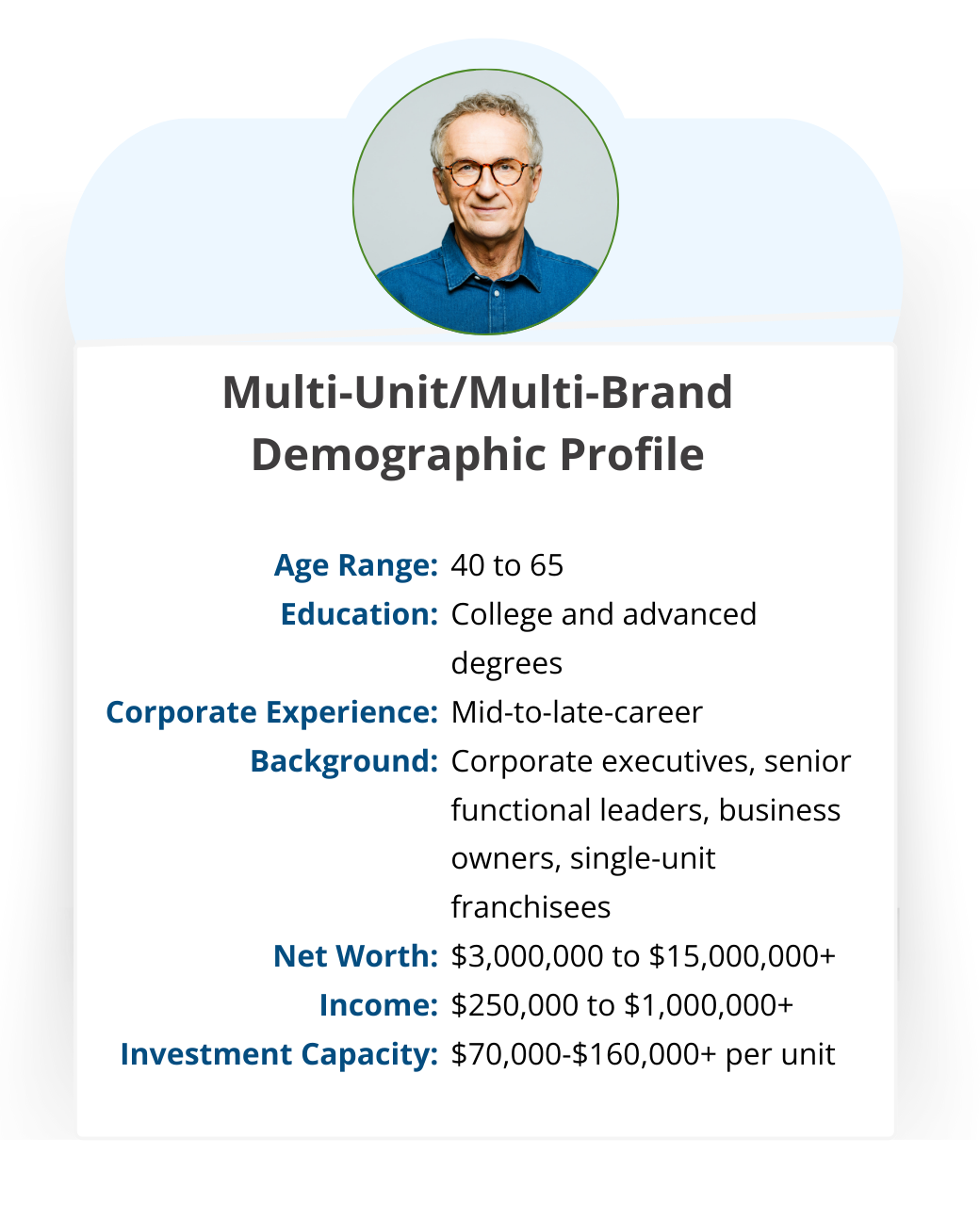

Age and life stage: Typically 40–65 years old, often married with children, and oriented toward long-term wealth preservation, intergenerational security, and lifestyle design instead of short-term experiments.

Career path: Prior backgrounds include corporate executives, senior functional leaders, business owners, or successful single-unit franchisees who have stepped up into multi-unit or area development roles.

Experience base: They are fluent in P&L management, KPIs, and operational systems, and many have led multi-location operations or large corporate departments before entering franchising.

Psychographically, this persona is competitive, growth-obsessed, and comfortable with complexity and risk—but expects structure, data, and discipline from their brands. They care deeply about culture, leadership quality, and system strength because weak brands slow scale, dilute returns, and increase operational friction.

Wealth, Capital, and Investment Profile

Serious multi-unit and multi-brand Moguls command the capital needed to build meaningful footprints and think about every decision through a portfolio lens. Their constraint is rarely access to money; it is whether a brand’s economics and scalability justify deploying that money over several years.

Net worth: Commonly in at least the low- to mid-seven figures, often around the $3 million–$15 million+ range for established multi-unit and area developers.

Income: Household income is typically $250,000–$1,000,000+ annually, well above the broader franchise owner average and reflecting the profit leverage that comes from multiple locations.

Per-unit investment: Per-unit ranges such as roughly $73,000–$164,000 are highly accessible, usually funded through a mix of cash, portfolio reallocation, and institutional lending.

For multi-unit development, they are comfortable deploying between $250,000 to over $1,000,000 in liquid capital over a 3–5 year schedule, often supplemented by SBA or bank financing and, at times, outside investors.

This persona thinks in terms of total project cost per unit (franchise fee, build-out, working capital, and reserves) multiplied across the full development schedule. They typically allocate 6–12 months of operating reserves per new location to buffer ramp-up volatility and macro shocks.

This persona closely monitors interest rates, debt service coverage ratios, and lender covenants. They will scrutinize whether projected unit economics can comfortably support both operations and growth-oriented borrowing. If the model does not generate enough free cash flow to de-risk leverage and fund future locations, they will slow development or pass on the brand altogether.

Core Motivations and Mindset

At the heart of the Multi-Unit / Multi-Brand Mogul is a desire for scale, control, and portfolio-level performance, not just single-unit income. They respond best when brands speak directly to long-term enterprise value and risk-adjusted returns. Their core motivations include:

Strategic wealth-building: They want to build a scalable asset that can reach multi-seven- or eight-figure enterprise value, not simply “buy themselves a job.” Strong unit economics, protected territories, and clear multi-unit or area development pathways are essential.

Economies of scale and leverage: Shared management layers, centralized marketing, purchasing power, and better terms with vendors, landlords, and even franchisors as their footprint grows are key parts of the appeal.

Autonomy and control: Many have left or plateaued in corporate environments and want to control their own destiny within a proven model, valuing authority over staffing, local marketing, and growth pace while still respecting brand standards.

They view their holdings through a portfolio lens, managing multiple units and often multiple brands across industries, geographies, and business models. This persona often blends semi-absentee, manager-run concepts with more operationally intensive models to balance time, risk, and cash flow.

What Types of Franchises Attract Them?

The Multi-Unit / Multi-Brand Mogul pursues brands and deal structures that justify serious capital deployment and organizational buildout. They evaluate concepts through a portfolio-investor lens, prioritizing scale, repeatable demand, and operational leverage.

Industry and concept preferences

They gravitate toward concepts with strong, proven unit economics and durable, repeatable demand, such as foodservice, home services, health and wellness, automotive, and other essential or recurring services. There is a growing preference for asset-light, service-based models with lower fixed overhead and more flexible staffing, including home services, cleaning, restoration, and mobile or on-site service concepts.Economic and operational characteristics

They want clear benchmarks for average unit volume, payback period, and store-level EBITDA, with a proven path to opening additional units every 12–18 months or faster. Concepts with tight menus or focused service offerings, standardized systems, and streamlined staffing are particularly attractive because they can be replicated across dozens of locations.Structural deal preferences: This persona favors multi-unit agreements, area development rights, or master franchise opportunities that grant meaningful territory control and a clear runway for expansion. They also value brands with robust infrastructure—detailed operations manuals, strong field support, centralized marketing, and clear standards that make scaling operationally feasible.

In many cases, they design a balanced franchise portfolio across industries, price points, and economic cycles, using multi-brand synergy (shared labor, cross-marketing, shared back office) to enhance returns and resilience.

Decision Timeline and Buying Process

The Mogul’s decision process is structured, analytical, and data-heavy. They may be decisive, but only when a brand provides the information needed to validate fit at a portfolio level.

Typical timing: Many serious prospects move from first conversation to signing in about 3–6 months, with more complex multi-unit or area development deals sometimes stretching to 6–9 months. In practice, a refined target is often a 2–4 month window from initial interest to signing when financial, operational, and territory data are readily available.

Process: Their journey usually includes structured discovery, FDD review, validation calls with existing franchisees, financial modeling, funding approvals, and discovery days or site visits. They often evaluate multiple brands simultaneously, running comparative models and scenario analyses across development schedules, capital requirements, and risk assumptions.

Because they typically pursue multi-unit or area development agreements, Moguls tend to negotiate more aggressively on fees, royalties, and development schedules, even while moving quickly when the opportunity aligns with their strategy. Spouses or partners are often involved in final decisions, especially when personal guarantees and significant capital are on the line.

Ultimately, their central question is less “Can this business work?” and more “Does this concept fit our portfolio thesis and growth plan over the next 5–10 years?”

Key Pain Points and Barriers

Despite their sophistication, Multi-Unit / Multi-Brand Moguls face distinct challenges that can slow or block investment if franchisors fail to address them.

Scaling operations and leadership: Shifting from hands-on operator to CEO of a multi-unit organization is demanding; hiring, training, and retaining strong unit managers and regional leaders quickly becomes the main constraint. Maintaining culture, quality, and consistency across multiple locations and brands is an ongoing pain point.

Capital intensity and cash flow risk: They worry about overcommitting to aggressive development schedules that strain cash flow, especially in high build-out concepts or when interest rates are elevated. Concerns include cost overruns, delayed openings, slower-than-expected ramps, and the need to maintain 6–12 months of reserves.

Debt and downside risk: Personal guarantees, multi-year leases, and exposure in a downturn are front-of-mind; they ask not just “Can this work?” but “What if we only achieve 60–70% of projected revenue?”

Brand and partner risk: They fear choosing the wrong franchisor—weak leadership, underfunded marketing, poor support, or strategic missteps that damage brand value, create territory saturation, or cause cannibalization.

Complexity and time constraints: Managing multiple brands, vendors, lenders, and locations can create operational and mental overload, especially for those still exiting corporate roles or other businesses.

Emotionally, this persona is less concerned with whether they can run a business and more focused on whether the brand and partnership can support the scale they plan to build.

How to Market To and Attract the Multi-Unit / Multi-Brand Mogul

To win this persona, franchisors must present themselves as strategic investment partners, not simply as purveyors of a lifestyle business. Messaging, content, and process should match the sophistication and expectations of a portfolio-minded operator.

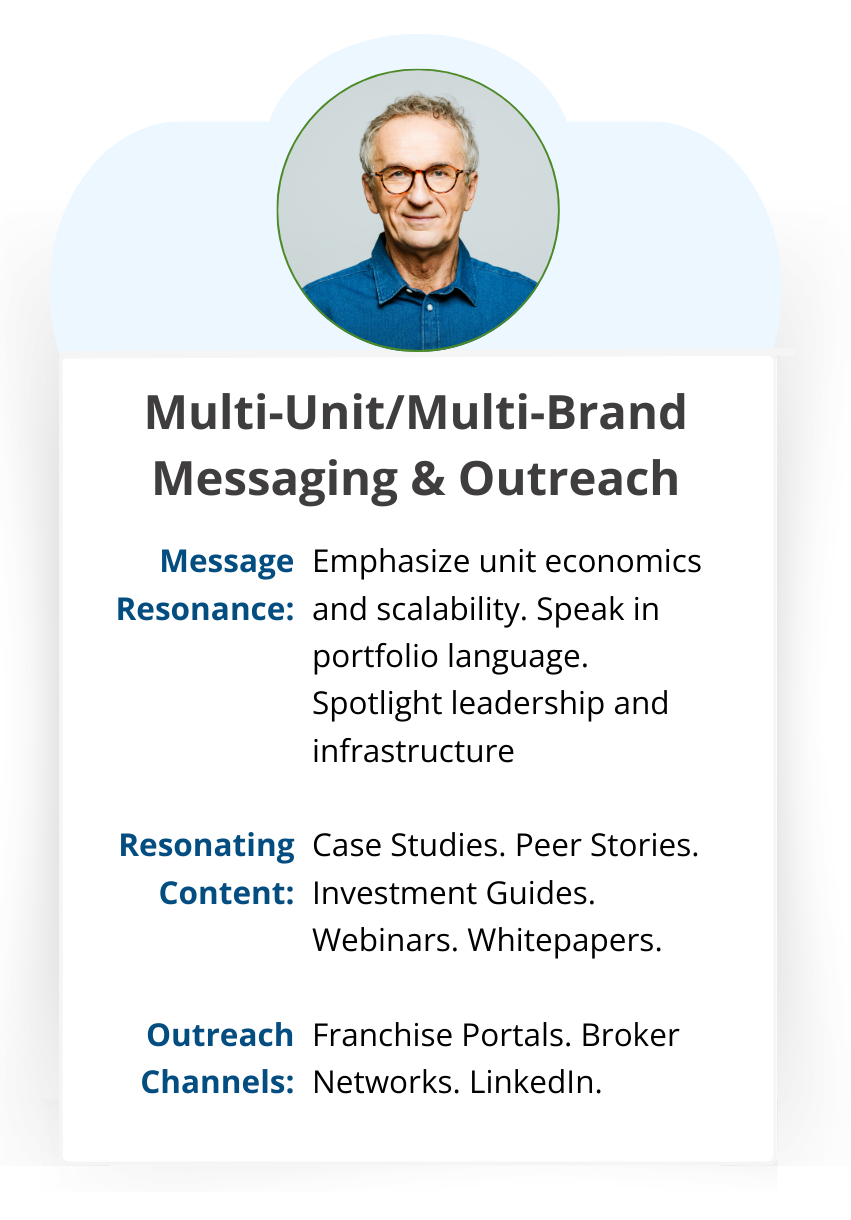

Positioning and Messaging

Emphasize unit economics and scalability: Share data on AUV ranges, breakeven timelines, average development velocity, and case studies of multi-unit owners (within legal and compliance boundaries).

Speak in portfolio language: Frame the concept in terms of diversification, recession resistance, cross-brand synergy, and long-term equity value, rather than just single-unit earnings.

Spotlight leadership and infrastructure: Introduce the executive team, field support, technology stack, and operating playbooks that enable multi-unit and multi-brand success.

Content That Resonates

The most effective content for this buyer persona is deep, practical, and proof-driven.

Case studies and peer stories: Profiles, interviews, and panels featuring existing multi-unit and multi-brand franchisees that show how they scaled from a few units to a regional platform.

Data-rich resources: Investment guides, webinars, and whitepapers that walk through capital requirements, financing structures, and growth scenarios, including conservative, base, and upside cases.

Development tools: Sample pro formas, territory planning tools, and org-chart templates that help them visualize how to grow from 1–3–5–10 units and when to add district managers or support roles.

Channels, Outreach, and Sales Process

Reaching the Mogul requires focused channels and a consultative, transparent approach.

Channels: High-yield touchpoints include franchise portals and broker networks, targeted LinkedIn outreach, multi-unit franchise and investor events, curated webinars for high-net-worth individuals, and private equity or family office networks.

Approach: Treat them as strategic partners; lead with mutual fit, territory strategy, and transparent financial discussions rather than hard selling or hype. Segment messaging to known multi-unit owners of other brands and acknowledge their sophistication explicitly.

Process design: Provide clear steps, timelines, and expectations for each stage—intro, FDD review, validation, discovery day, decision—and make it easy to model scenarios with adjustable pro formas and staffing models.

De-Risking and Building Trust

Overcoming their hesitations means directly addressing financial, operational, and brand-risk concerns.

Financial de-risking: Connect candidates with franchise-savvy lenders and SBA specialists, and provide realistic, conservative projections with sensitivity analysis and examples of how operators navigated slower ramps.

Brand confidence: Facilitate conversations with top-performing multi-unit franchisees who can speak candidly about support quality, challenges, and real outcomes. Demonstrate depth of support in operations, marketing, technology, and training—especially how these resources scale with multi-unit groups.

Lifestyle and operational clarity: Show what an “average week” looks like for a scaled multi-unit owner and how a manager-led model works in practice, backed by playbooks and real organizational examples.

Final Thoughts

Franchisors that recognize and design specifically for the multi-unit/multi-brand Mogul—in messaging, deal structure, and support—can unlock faster market penetration, stronger operators, and more durable system-wide growth.

Stay tuned for next month’s article, where the series will continue with another key franchise buyer persona. Don’t forget to review our previous looks at the